Check your Unsecured Business Finance Eligibility

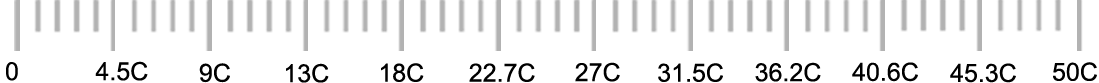

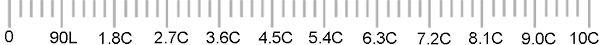

Loan amount you need?

Rs.

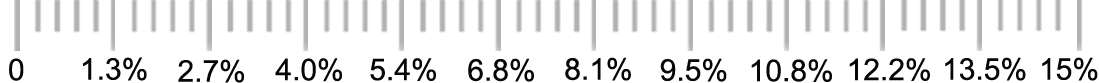

Rate of Interest

%

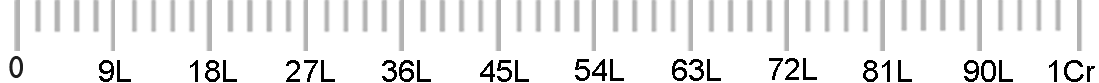

Tenure

Years

Months

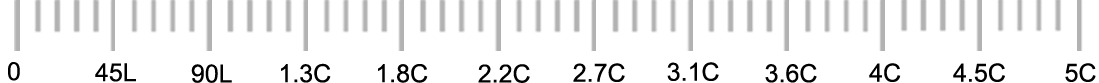

What is your annual turnover?

What is your annual receipt?

Rs.

What is your rental income(monthly)?

Rs.

Total Existing EMIs on all loans (Monthly)?

Rs.

Total Monthly Interest Paid to bank in CCOD Limit ?

Rs.

Unsecured Secured Business Finance is a Collateral Free type of business funding for Manufacturing & Service Industry.

At BizzCap Advisors we help the Self Employed Professional (Doctors, Architectures etc. ) & Self Employed Non Professional/ Businessmen to get the Unsecured Business Loan from various Bank & NBFC's at compatible Interest Rates.

We also helps the client to Avail Loan under Varios Goverment Schemens such as CGTSME, Standup India, StartUP India, Mudra Loan Scheme from various Nationalised Banks & Goverment Institutions Like SIDBI, NSIC etc.

The prupose of the loan is mainly for Business Expansion, Purchase Of Raw Material, Purchase Of Equipments, Payments to Supplier.

- Loan Amount:- Min 5 Lacs- 500 Lacs

- Tenure:- 12 Months - 48 Months

- ROI: From 13.50% - 21%

- Processing Fee: Upto 2%

Eligibility For Unsecured Business Finance

• Age limit 18 - 70 years for Business Loan. However, some banks Have different age limits for self-employed and self-employed professionals.• Maximum loan tenure up to 3 years.

• Minimum Annual Turn Over is 1Cr. for Manufacture & trader .

• Minimum Loan Amount is Rs 10 lakhs and Maximum limit is Rs 1 crore, in select cases up to Rs 5 crore (T & C apply).

Documents Required For Unsecured Business Finance

Self Employed

- Filled Application form

- Applicant & Co-Applicant KYC : Pan Card, Aadhar Card, Driving License, Passport, Residence Electricity Bill of Promoter/ Partners/ Directors.

- Proof of Business: PAN for Partnership & Pvt Ltd, Partnership Deed in Case Of Partnership Firms, MOA & AOA with Incorporation Certificate for Pvt Ltd Firm, Shop Act Licence, UAN Certificate, GST Certificate, VAT Certificate, TIN Certificate.

- Proof of Income: IT Returns with Computation of Income , Balance Sheet with Audit Report for last 3 years along certified by CA.

- Banking: Last 12-months bank statement for operative account both professional and business.

- Previous Loan Sanction Letters and 1 Year GSTR3B Challans.

The Business Loan is an unsecured amount that can be availed as loan. The minimum range of loan is 5 lakhs and the maximum amount of loan is 30 lakhs.

The time period is minimum 12 months to refund the loan amount and can be extended upto a time period of 48 months.

The rate of interest in the Business Loan are fi with pre-decided fixed rates.

You can very easily repay the Business Loan amount through the following methods:

- Post Dated Cheques

- ECS

The Business Loan is provided to people who are self employed doctors, medical practitioners, Business entities, self employed non-professionals. You are required to have the KYC Documents, Bank Account Statement and all the identity proof for the business need to be shared with the application.

The good thing about Business Loan is the fact that you are not required to submit any kind of security collateral for the purpose of availing the Business Loan.

Generally, there is a locking period for about 6 months to an year for the purpose of refunding the Business Loans. There are options that after paying the first EMI you can very easily work towards returning the business loan amount with the upfront fees of 2%-5% that will be beneficial for the purpose of getting the loan finished in a short span of time.

It generally takes a time period of about 5-7b days to disburse the loan in an effective manner.

If due to any reason your EMI get bounced or is missed then you have to pay extra charges. Sometimes due to the severity of the occasion sometimes legal actions are taken towards the borrower.

For the purpose of Business Loan some banks allow the part payment, however, there are a lot of restrictions to carry out the payout.

| Banks Name | Interest rate | Processing fees |

|---|---|---|

| Aditya Birla Finance Ltd | 16% - 21% | 2% + GST |

| Axis Bank Ltd | 16% - 21% (MCLR- 8.90% Plus Spread 7.10% - 15.10% ) | 2% + GST |

| Bajaj Finance Ltd | 18% Onwards | 2% + GST |

| Capital First Ltd | 19% – 28% | 2% + GST |

| Clix Capital Services Pvt Ltd | 18% - 24% | 2% + GST |

| Deutsche Bank | 14%-20% | 2% + GST |

| EDELWEISS RETAIL FINANCE LIMITED | 19% – 22% | 2% + GST |

| Equitas Small Finance Bank | 16% - 20% | 2% + GST |

| Fullerton India Credit Co. Ltd | 19% – 28% | 2% + GST |

| HDB Financial Services Ltd. | 16% - 20% | 2% + GST |

| HDFC Bank Ltd | 15% – 18% | 2% + GST |

| ICICI Bank Ltd | 16% – 21% | 2% + GST |

| IIFL (India Infoline Finance Ltd) | 18 to 25% | 2% + GST |

| IndiaBulls Finance Ltd | 19% – 22% | 2% + GST |

| Indusind Bank Ltd. | 16%-21% | 2% + GST |

| Capital Intek | 19% – 22% | 2% + GST |

| Janlakshmi Financial | 18 to 25% | 2% + GST |

| Kotak Mahindra Bank | 16% – 21% | 2% + GST |

| Magma Fincorp Ltd | 19% – 22% | 2% + GST |

| Neo Growth Credit Pvt Ltd | 19% 24% | 2% + GST |

| Ratnakar Bank Ltd | 16% – 22% | 2% + GST |

| Reliance Capital Ltd | 16% – 22% | 2% + GST |

| Shriram City Union Finance Ltd | 16% – 22% | 2% + GST |

| Standard Chartered Bank | 16% – 22% | 2% + GST |

| Tata Capital Financial Services Ltd. | 18%-24% | 2% + GST |

| United Petro Finance | 18% – 24% | 2% + GST |

| Vistaar Financial Services Pvt Ltd - Banglore | 18% – 24% | 2% + GST |

| Yes Bank | 16% – 22% | + GST |

.png)

Self-Employed

Self-Employed  Self-Employed Professional

Self-Employed Professional