Check your Home Loan Eligibility

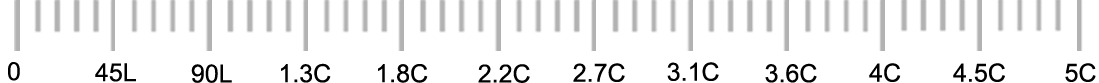

Loan amount you need?

Rs.

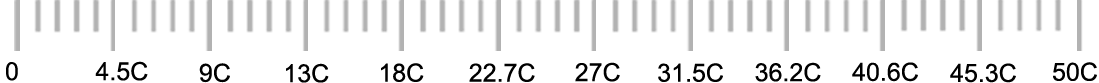

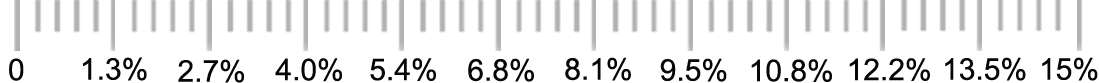

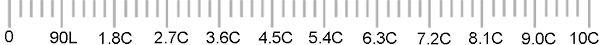

Rate of Interest

%

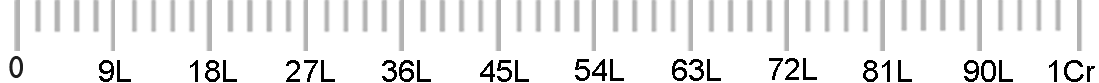

Tenure

Years

Months

What is your annual turnover?

What is your annual receipt?

Rs.

What is your rental income(monthly)?

Rs.

Total Existing EMIs on all loans (Monthly)?

Rs.

Total Monthly Interest Paid to bank in CCOD Limit ?

Rs.

Every man’s Dream – to build a house of his own for his children. Avail home loan from us at affordable rate of interest.

Having a home of your own with the comfortable stay is no more a luxury - it has become a necessity. A place which you call your own - spend beautiful and special moments with family member that becomes memories of a lifetime.

We want to help you realist this dream- we aim to bring out some of the best home loan packages that will help you get comprehensive solutions to make your dream a reality.

Different type of Home Loans that we offer:

- Home Construction Loan

- Plot Purchase Loan

- Plot Construction

- Home Renovation Loan

- Home Extension Loan

- Home Loan For NRI

Salaried :

- Individuals in permanent service in Government or reputed companies.

- Applicant should be 21 years of age at the time of loan commencement and upto the age of 60 years or superannuation; whichever is earlier at the time of loan maturity.

Self- Employed :

- Any individual filing income tax returns can apply.

- Applicant should be 21 years of age at the time of loan commencement and upto the age of 60 years or superannuation; whichever is earlier at the time of loan maturity.

Self Employed Professional :

- Professionals (i.e., doctors, engineers, dentists, architects, chartered accountants, cost accountants, company secretary, management consultants only) can apply.

- Applicant should be 21 years of age at the time of loan commencement and upto the age of 60 years or superannuation; whichever is earlier at the time of loan maturity.

Documents Required For Home Loan

Salaried

- Filled Application form

- Passport size Photograph

- Voters ID/Pan Card/Valid Passport/Aadhar Card/Valid driving license with photograph.

- Proof of Income: Latest 3 Month salary slip / Certificate for Fixed Salary / Latest 3 years form-16 and Last 12- months bank statement / Passbook of salary account.

- Proof of residence: Latest electricity bill / Utility bill piped gas bill / telephone bill /Passport / Registered lease agreement with a utility bill in the name of landlord.

- Pan Card (In Partnership, Pvt Ltd. Firm )

Self Employed

- Filled Application form

- Passport size Photograph

- Proof of Income: IT returns for the last 3 years along with computation of income certified by CA

- Last 12-months bank statement for operative account both professional and business

- Proof of residence: Latest electricity bill / Utility bill piped gas bill / telephone bill /Passport / Registered lease agreement with a utility bill in the name of landlord.

- Proof of Business: Shop and Establishment certificate / Vat registration certificate / Service tax Certificate

- Voters ID/Pan Card/Valid Passport/Aadhar Card/Valid driving license with photograph.

Self Employed Professional

- Filled Application form

- Passport size Photograph

- Voters ID/Pan Card/Valid Passport/Aadhar Card/Valid driving license with photograph.

- Proof of Income: IT returns for the last 3 years along with computation of income certified by CA

- Proof of Business: Shop and Establishment certificate / Vat registration certificate / Service tax Certificate

- Last 6-months bank statement for operative account both professional and business

- Proof of residence: Latest electricity bill / Utility bill piped gas bill / telephone bill /Passport / Registered lease agreement with a utility bill in the name of landlord.

- Pan Card required (In Partnership, Pvt Ltd. Firm )

Making dreams come true – is an opportunity & memory of a lifetime. Few things to be kept in mind while realizing the dream of building a house :

- Rate of interest

- EMI

- Processing free

- Loan eligibility

- Tenure of loan – for repayment capability; you also need to further understand

- Incase; you are buying a flat, possession time-frame of the house.

- Incase; you are buying a plot of land – how much time will it take to construct the house.

We, at New Delhi Financial, provide a platform for you to compare multiple home loan providers.

Through our portal; you can view, compare multiple options available in the market.

Our team can also facilitate you in understanding which option / scheme can be best suited for you.

Our team can also facilitate you in understanding which option / scheme can be best suited for you.

Yes, the registration charges, transfer charges and the stamp duty charges are all included in the cost calculation of home loan.

No, currently we are offering these services – at no charge to you.

Yes, there are options available for buying a house in a different city.

Yes, a down payment of about 20-25% has to be paid for the loan. One can easily take a home loan through showcasing savings.

Here are some factors that banks consider for applying for Home Loan:

- Income Details of the Applicant

- Age of the Applicant During Application

- Number of Family Members Supported by Applicant

- Assets and Liability of the Applicant

- Stability of the Applicant

The EMI is calculated on the below factors:

- Loan Amount Taken

- Time Frame of the Repayment

- Rate of Interest During the Time of Loan Apply

Every month a fixed date is assigned as the due date.

Yes, as per the Income Tax act, the Indian residents avail benefits on Home Loan Principal Amount and Interest Rate.

The EMI is calculated on the below factors:

- Standing Instruction

- Post Dated Cheque

- Electronic Clearing Service

You can easily keep a track of the Account statements through the following methods for the Home Loam and Repayment Schedule:

- Through Call- Simply call at the toll free numbers of the bank.

- Send a Mail- Mail the authorised department and get the updates.

- Check in the Branch- Go to the branch of the concerned branch and check.

The maximum amount can be Rs 25,00,00, 000 and minimum can be Rs 3,00,000

| Banks Name | Interest rate | Processing fees |

|---|---|---|

| Andhra Bank | One Year MCLR + 1.20% | INR 300 Per Lakh + GST (Min:Rs.1000/- and Max:25000 plus Tax) |

| Bank Of Baroda | One Year MCLR + 1.20% | Minimum: Rs. 7,500/- to Maximum: Rs.1,50,000/- |

| Canara Bank | One Year MCLR + 3.00% | 0.50% (Min Rs.1500/- and Max. Rs.10,000/-) |

| South Indian Bank | One year MCLR+2.00% | Upto 1% + GST |

| PNB Housing Finance | 10.50% | Upto 1% + GST |

| Citi Bank | 9.50% | Upto 1% + GST |

| DCB Bank Ltd | 10.00% - 12.75% | Upto 1% + GST |

| ICICI LAP | 10.00% to 12.00% | Upto 1% + GST |

| Axis Bank Ltd | 11%-12.10% | Upto 1% + GST |

| Edelweiss Finance Ltd. | 11.50% - 12.75% | Upto 1% + GST |

| Essel Finance | 9.00% - 10.00% | Upto 1% + GST |

| Fedbank Financial Services Ltd. | 9.50% | Upto 1% + GST |

| Fullerton India Credit Co. Ltd | 10.00% - 12.75% | Upto 1% + GST |

| HDB Financial Services Ltd. | 10.00% - 12.75% | Upto 1% + GST |

| IDFC Bank Ltd | 8.75% to 10.75% | Upto 1% + GST |

| RBL Bank Limited | 10.50% to 12.75% | Upto 1% + GST |

| L & T Finance Ltd | 10.75% to 12.50% | Upto 1% + GST |

| India bulls | 09.00% to 11.75% | Upto 1% + GST |

| Deutsche Bank | 9.00% to 10.00% | 0.75% + GST |

| DCB Bank | 10.00% to 12.75% | Upto 1% + GST |

| Cholamandalam | 10.00% to 12.75% | Upto 1% + GST |

| Capri Global | 12.00% to 13.75% | Upto 1% + GST |

| Bhandhan Bank | 12.00%-16.00% | Upto 1% + GST |

| Reliance Capital | 11.00% to 12.75% | Upto 1% + GST |

| Shriram Housing | 12.00% to 18.00% | Upto 1% + GST |

| Aadhaar Housing | 13.00% to 15.00% | Upto 1% + GST |

| Capital First | 13.00% to 18.00% | Upto 1.5% + GST |

| Aditya Birla Home Finance | 10.00% to 12.00% | Upto 1% + GST |

| Magma Housing | 12.00% to 15.00% | Upto 2% + GST |

| Yes Bank | 10% to 11% | Upto 1% + GST |

.png)

Salaried

Salaried Self-Employed

Self-Employed  Self-Employed Professional

Self-Employed Professional