Check your Auto Loan Eligibility

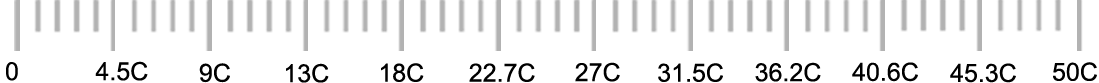

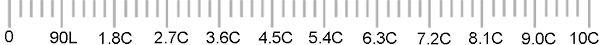

Loan amount you need?

Rs.

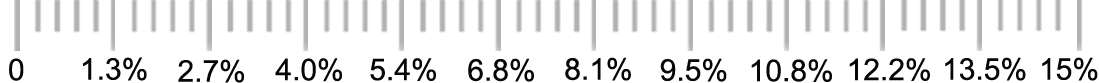

Rate of Interest

%

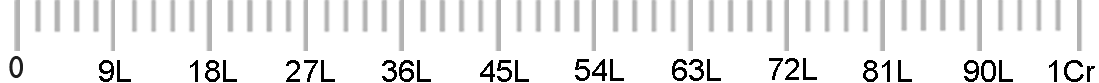

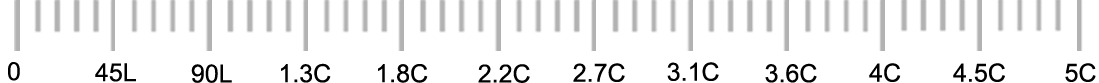

Tenure

Years

Months

What is your annual turnover?

What is your annual receipt?

Rs.

What is your rental income(monthly)?

Rs.

Total Existing EMIs on all loans (Monthly)?

Rs.

Total Monthly Interest Paid to bank in CCOD Limit ?

Rs.

Bizzcap Advisors is one of the largest loan service portal and we have tie ups with the leading banks & financial institutions providing the car loans.

The car loan is the great way to drive your dream car without having to make the complete payment upfront. Some other features which make car loan tempting are:

- Flexible contract terms & comfortable tenure of loan i.e. up to the 7 years.

- Competitive & attractive interest rates for car finance.

- The tax deduction can be applicable if a vehicle is used for the business purposes.

- Almost everyone with the Permanent Income may apply for the car loan/ auto loan.

- Some banks offer up to the 100 percent of car finance on the ex showroom price & normally up to the 85 percent of car finance on the ex showroom price is available.

- Very less processing fees & prepayment charges.

| Age | Minimum 21 Years and Maximum 65 Years |

| Net Income Requirement | Upwards Rs.10,000 p.m |

| Employment- Type Stability | For Salaried or Self-employed 3 years total experience or years in business or profession, 2 years in the current post or business or profession |

| Car Type | Old vs. New : affect the loan amount |

| Car Value | Affect the loan amount |

| Car Model | Approved model |

| Residence- Area Stability | Urban or Semi urban or Rural 1 year stay at the current residence |

First, shop around for all various finance schemes on Auto Loans available in the market on DealsofLoan. You can decide from margin money scheme, advance EMI’s scheme & deposit payment schemes. Normally margin money schemes offer best terms, but at the end of a day, effective rate of interest of the loan is essentially matters. This method provides common podium for the assessment of different schemes by discounting on basis of the cash flow.

For an income proof, most banks look at your IT returns for last 2 yrs. & at the nature of income. However, some banks don’t consider the speculative income from a stock market, rental or agricultural income. Some banks discount such income by up to the 50 percent in their workings.

If all the required documents are in order, your process moves fast. You are necessary to submit the required documents such as salary slip, tax returns, proof of residence, bank statement etc. The processing takes between 2 – 7 days.

There is not compulsion for you to have an account with a bank. Usually, banks have no any problem in giving auto loans to people who don’t have an account with them. However, there are certain privileges you can enjoy with having an account of the same bank you take the loan from.

Well , if you have good repayment record for an earlier transactions, YES! You are most likely to get a less lending rate & your process is sure to move the faster. Also, do check out some another offers from other banks, before taking a final decision. And this is where DealsofLoan can assist you in getting multiple quotes from various different banks.

.png)

Salaried

Salaried Self-Employed

Self-Employed  Self-Employed Professional

Self-Employed Professional