Check your Commercial Vehical Finance Eligibility

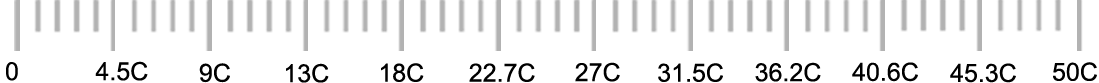

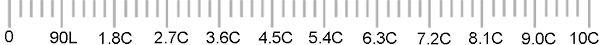

Loan amount you need?

Rs.

Rate of Interest

%

Tenure

Years

Months

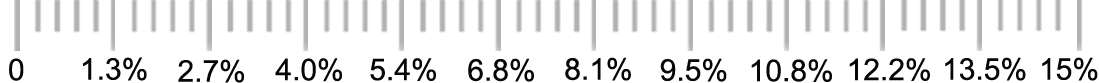

What is your annual turnover?

What is your annual receipt?

Rs.

What is your rental income(monthly)?

Rs.

Total Existing EMIs on all loans (Monthly)?

Rs.

Total Monthly Interest Paid to bank in CCOD Limit ?

Rs.

Commercial Vehicle Loan is given to Individauls, self-employed, trust, organisation etc. for small to heavy vehicle for commercial or business purposes. Most of the prominent banks offer commercial vehicle loan on easy EMI that can be monthly, quarterly or yearly.

Eligibility For Commercial Vehical Finance

• Eligible customers:- Individuals, Proprietorships, Partnership firms, Companies.• Eligible vehicles:- Buses, trucks, tippers, trailers, tankers and other light & small commercial vehicles.

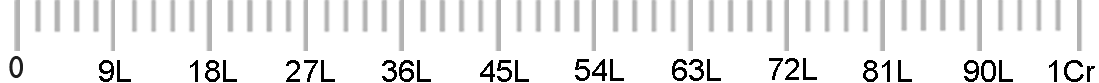

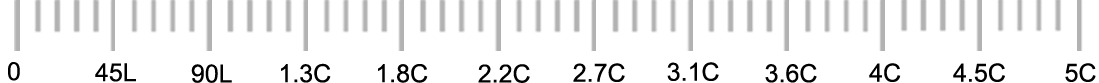

• Loan Amount:- Upto 5 Cr.

• Security:- Hypothecated vehicle/Guarantor.

• Interest Rates:- 10% - 16% .

• Tenure:- Upto 5 Years.

Documents Required For Commercial Vehical Finance

Self Employed

- Filled Application form

- Applicant & Co-Applicant KYC : Pan Card, Aadhar Card, Driving License, Passport, Residence Electricity Bill of Promoter/ Partners/ Directors.

- Proof of Business: PAN for Partnership & Pvt Ltd, Partnership Deed in Case Of Partnership Firms, MOA & AOA with Incorporation Certificate for Pvt Ltd Firm, Shop Act Licence, UAN Certificate, GST Certificate, VAT Certificate, TIN Certificate.

- Proof of Income: IT Returns with Computation of Income , Balance Sheet with Audit Report for last 3 years along certified by CA.

- Banking: Last 12-months bank statement for operative account both professional and business.

- Previous Loan Sanction Letters and 1 Year GSTR3B Challans.

| Banks Name | Interest rate | Processing fees |

|---|---|---|

| Mahindra Finance | MCLR Rate + Applicable Bank Rates | 1% + GST |

| Sundram Finance | MCLR Rate + Applicable Bank Rates | 1% + GST |

| Magma Fincorp | MCLR Rate + Applicable Bank Rates | 1% + GST |

| HeroFincorp | 10.50% | 1% + GST |

| HDFC Bank Ltd | 9.50% | 1% + GST |

| ICICI Bank Ltd | 10% | 1% + GST |

.png)

Self-Employed

Self-Employed