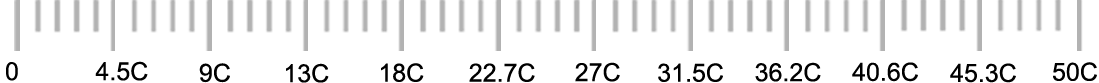

Loan amount you need?

Rs.

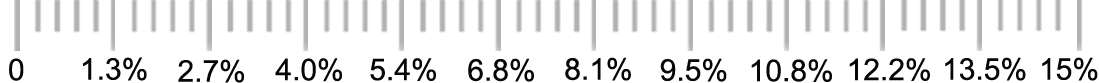

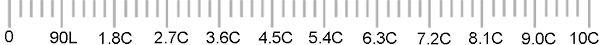

Rate of Interest

%

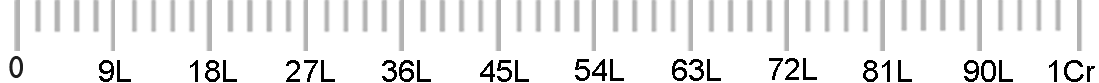

Tenure

Years

Months

What is your annual turnover?

What is your annual receipt?

Rs.

What is your rental income(monthly)?

Rs.

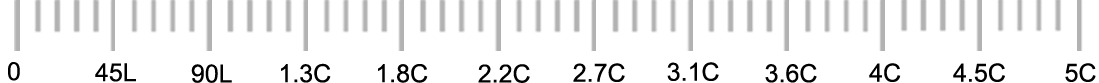

Total Existing EMIs on all loans (Monthly)?

Rs.

Total Monthly Interest Paid to bank in CCOD Limit ?

Rs.

Credit RATING is an evaluation of the creditworthiness of an enterprise or company in general based upon past records of debt repayment, financial status, etc. It is a judgement about whether a borrower will be able to pay back a loan, based on their past history.

Simply put, credit rating refers to the expression of opinion concerning debt instrument, based on credit risk evaluation, given by rating agency as on a particular date, indicating the probability of principal plus interest to be met by the borrower in a timely manner.

Our Role:-

1. Collection of mandatory documents required for the Rating outcome from the Company or Firm.2. Inhouse assesment of the Financial Statements and busines model of the firm to identify the strength and weakness with the peer competitors.

3. Initial discussion with the CRAs for the Rating Outlook.

4. Analytical Discussion & Company Presentation with CRA on Company or Firm behalf.br> 5. Acceptance of the Credit Rating with Partners Approval for the Press Release.

6. Other Services: Inputs on Financial Statements, Collection of Bankers Feedback and all other services during the rating process.

.png)