Check your Agri Finance Eligibility

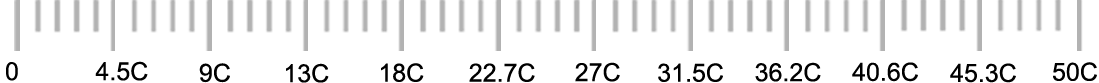

Loan amount you need?

Rs.

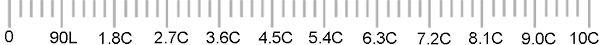

Rate of Interest

%

Tenure

Years

Months

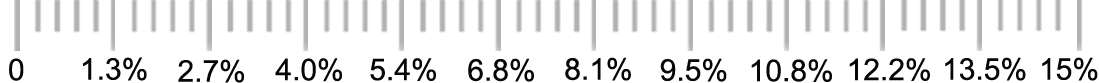

What is your annual turnover?

What is your annual receipt?

Rs.

What is your rental income(monthly)?

Rs.

Total Existing EMIs on all loans (Monthly)?

Rs.

Total Monthly Interest Paid to bank in CCOD Limit ?

Rs.

Complete Solution of all your Agricultural Credit Needs!!!!!!! If you are a Farmer or Individual Agriculturist or Corporate / Firm engaged in agriculture & allied activities such as Poultry Farming or Dairy Farming etc - we can help you to expand your business through various financial products from the Financial Institutions.

(a) Retail Agri Loan

(b) Long term Loan for agriculture & allied activities (Agri Term Loan)

You can get term loans to buy cattle or agriculture equipment as a part of the Agricultural Term Loan (Agri TL) scheme from various banks. Repay these loans over a period of 3-4 years in monthly/Half yearly/ Yearly instalments as per your convenience.

Eligibility For Agri Finance

• Age limit 18 - 70 years for Loan Against Property. However, some banks Have different age limits for salaried, self-employed and self-employed professionals.• Residential property, commercial property and industrial property are the most eligible securities for loan against property.

• Maximum loan tenure up to 7 years.

Documents Required For Agri Finance

Self Employed

- Filled Application form

- Applicant & Co-Applicant KYC : Pan Card, Aadhar Card, Driving License, Passport, Residence Electricity Bill of Promoter/ Partners/ Directors.

- Proof of Business: PAN for Partnership & Pvt Ltd, Partnership Deed in Case Of Partnership Firms, MOA & AOA with Incorporation Certificate for Pvt Ltd Firm, Shop Act Licence, UAN Certificate, GST Certificate, VAT Certificate, TIN Certificate.

- Proof of Income: IT Returns with Computation of Income , Balance Sheet with Audit Report for last 3 years along certified by CA.

- Banking: Last 12-months bank statement for operative account both professional and business.

- Previous Loan Sanction Letters and 1 Year GSTR3B Challans.

Property Documents for Self Employed:

Copies of all property documents of the concern property that you chose to pledge for the loan:

- Registered Agreement,

- Copy of Approved Sanction Plan

- NA Order

- 7/12 Extract

- Property Development Agreement

- Title Search Report

- Commencement Certificate

- Completion Certificate

.png)

Self-Employed

Self-Employed