Check your Secured Business Finance Eligibility

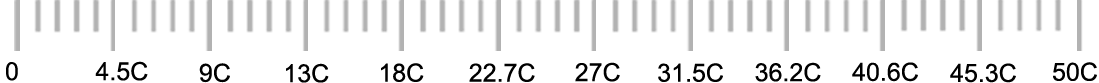

Loan amount you need?

Rs.

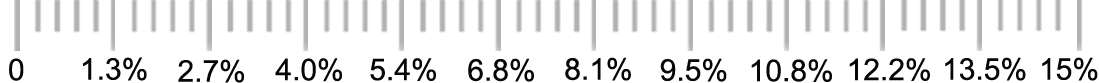

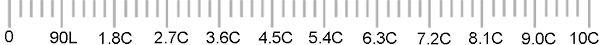

Rate of Interest

%

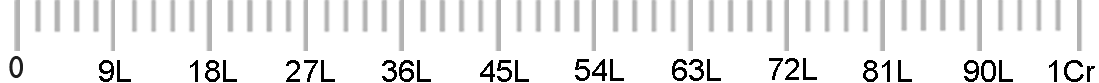

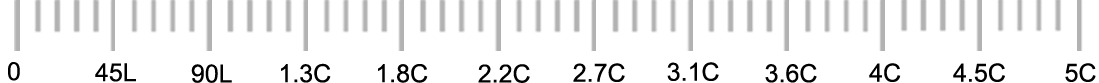

Tenure

Years

Months

What is your annual turnover?

What is your annual receipt?

Rs.

What is your rental income(monthly)?

Rs.

Total Existing EMIs on all loans (Monthly)?

Rs.

Total Monthly Interest Paid to bank in CCOD Limit ?

Rs.

Secured Business Finance is a type of business funding instrument secured by pledging valuable asset as collateral to Self Employed Professional, Self Employed Non Professional/ Businessman .

At BizzCap Advisors we help you to get the Secured Business Finance through Term Loan Against Residential, Commercial or Industrial Property, LAP- OD,Term Loan for Commercial Purchase, Lease Rental Discounting againt the Rent Recivable for a specified time period.

The prupose of the loan is mainly for Business Expansion, Purchase Of Raw Material, Purchase Of Equipments, Payments to Supplier.

- Loan Amount:- Min 10 Lacs- 20 Cr.

- Tenure:- Upto 15 Years

- Property Cosidered:- Residential, Commercial, Industrial & Plot

- ROI: From 9.50% - 18%

- Processing Fee: 1%

- Pre Payment Charges:- NIL

Eligibility For Secured Business Finance

• Age limit 18 - 70 years for Loan Against Property. However, some banks Have different age limits for salaried, self-employed and self-employed professionals.• Residential property, commercial property and industrial property are the most eligible securities for loan against property.

• Maximum loan tenure up to 18 years, overdraft available.

• One of variants of business & personal loans & (in the last) rate of interest in Loan Against Property typically remains just half of unsecured loans & tenure can go up to 15 years.

Documents Required For Secured Business Finance

Self Employed

- Filled Application form

- Applicant & Co-Applicant KYC : Pan Card, Aadhar Card, Driving License, Passport, Residence Electricity Bill of Promoter/ Partners/ Directors.

- Proof of Business: PAN for Partnership & Pvt Ltd, Partnership Deed in Case Of Partnership Firms, MOA & AOA with Incorporation Certificate for Pvt Ltd Firm, Shop Act Licence, UAN Certificate, GST Certificate, VAT Certificate, TIN Certificate.

- Proof of Income: IT Returns with Computation of Income , Balance Sheet with Audit Report for last 3 years along certified by CA.

- Banking: Last 12-months bank statement for operative account both professional and business.

- Previous Loan Sanction Letters and 1 Year GSTR3B Challans.

Property Documents for Self Employed:

Copies of all property documents of the concern property that you chose to pledge for the loan:

- Registered Agreement,

- Copy of Approved Sanction Plan

- NA Order

- 7/12 Extract

- Property Development Agreement

- Title Search Report

- Commencement Certificate

- Completion Certificate

The best way to apply for a Loan Against Property is to go through the packages offered by us for the same. You can also check out the guidelines of the Eligibility Section.

Loan against Property can be availed against residential and commercial property.

You can avail an amount starting from Rs 2 lakh to Rs 500 lakh depending on the value of the property. However, the banks generally consider the following factors before providing approval:

- Market Value of the Property

- Registration of the Property

- Income and Repayment Capacity of the Individuals

There is a non-refundable fee that is required to be paid for applying for LAP. It is approx 1% of the total Loan Amount along with Service Tax.

The bank takes 4 – 5 days to disburse the loan; once the documentation process is complete and the eligibility is established.

Yes, if you are a salaried person then banks offer LAP to NRI customers.

If the person is the Co-Owner of the property then he/she will also apply as the Co-Applicant. So it is not necessary to have a co-applicant.

Yes, all the banks have the provision of the part- prepayment at the nearest branch locations. Once the pre payment is done then you can either reduce the EMI cost or reschedule the tenure of the EMI so that the loan can be repaid within time.

You can easily track your LAP status in the following ways:

- Call the Bank on the Toll-Free Number

- Mail on the registered mail id of the branch

- Visit the bank branch personally

Here are the three ways through which you can make the payment:

- Standing Instruction

- Electronic Service Clearing

- Post Dated Cheques

| Banks Name | Interest rate | Processing fees |

|---|---|---|

| Andhra Bank | One year MCLR+2.05%+0.25% | Processing charges @300/lakh + S.tax (Minimum:Rs.1000/- and Maximum:25000 plus Tax) |

| Bank Of Baroda | One year MCLR plus Strategic Premium | Minimum: Rs. 7,500/- to Maximum: Rs.1,50,000/- |

| Canara Bank | One Year MCLR + 3.00% | 1% of loan amount with a minimum of Rs.5000/- and maximum of Rs. 50,000/-. |

| South Indian Bank | One year MCLR+2.00% | Upto 1% + GST |

| PNB Housing Finance | 10.50% | Upto 1% + GST |

| Citi Bank | 9.50% | Upto 1% + GST |

| DCB Bank Ltd | 10.00% - 12.75% | Upto 1% + GST |

| ICICI LAP | 10.00% to 12.00% | Upto 1% + GST |

| Axis Bank Ltd | 11%-12.10% | Upto 1% + GST |

| Edelweiss Finance Ltd. | 11.50% - 12.75% | Upto 1% + GST |

| Essel Finance | 9.00% - 10.00% | Upto 1% + GST |

| Fedbank Financial Services Ltd. | 9.50% | Upto 1% + GST |

| Fullerton India Credit Co. Ltd | 10.00% - 12.75% | Upto 1% + GST |

| HDB Financial Services Ltd. | 10.00% - 12.75% | Upto 1% + GST |

| IDFC Bank Ltd | 8.75% to 10.75% | Upto 1% + GST |

| RBL Bank Limited | 10.50% to 12.75% | Upto 1% + GST |

| L & T Finance Ltd | 10.75% to 12.50% | Upto 1% + GST |

| India bulls | 09.00% to 11.75% | Upto 1% + GST |

| Deutsche Bank | 9.00% to 10.00% | 0.75% + GST |

| DCB Bank | 10.00% to 12.75% | Upto 1% + GST |

| Cholamandalam | 10.00% to 12.75% | Upto 1% + GST |

| Capri Global | 12.00% to 13.75% | Upto 1% + GST |

| Bhandhan Bank | 12.00%-16.00% | Upto 1% + GST |

| Reliance Capital | 11.00% to 12.75% | Upto 1% + GST |

| Shriram Housing | 12.00% to 18.00% | Upto 1% + GST |

| Aadhaar Housing | 13.00% to 15.00% | Upto 1% + GST |

| Capital First | 13.00% to 18.00% | Upto 1.5% + GST |

| Aditya Birla Home Finance | 10.00% to 12.00% | Upto 1% + GST |

| Magma Housing | 12.00% to 15.00% | Upto 2% + GST |

| Yes Bank | 10% to 11% | Upto 1% + GST |

.png)

Self-Employed

Self-Employed  Self-Employed Professional

Self-Employed Professional