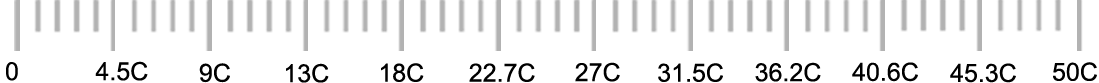

Loan amount you need?

Rs.

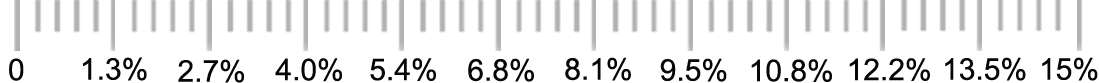

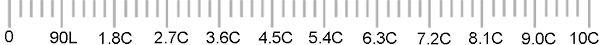

Rate of Interest

%

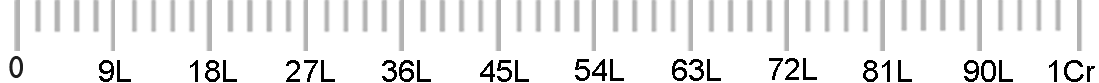

Tenure

Years

Months

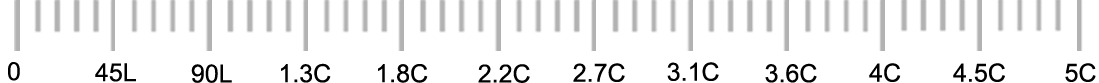

What is your annual turnover?

What is your annual receipt?

Rs.

What is your rental income(monthly)?

Rs.

Total Existing EMIs on all loans (Monthly)?

Rs.

Total Monthly Interest Paid to bank in CCOD Limit ?

Rs.

Our expert team at New Delhi Financial aims to manage your business tax compliance and ensures to offer you the perfect advisory services for the same. At every stage of business; tax plays a pivotal role. With innovative strategies, we work towards reducing the taxation compliances for you.

For our corporate clients, we work towards building and developing customized strategies for the purpose of tax benefits and effective tax structuring. We help in extending a wide range of tax management and business advisory services.

.png)